Clean Energy Tax Credit

25C Federal Tax Credit Offers Significant Savings When You Buy a Qualified HVAC System.

The Inflation Reduction Act offers tax savings for homeowners with purchases of high-efficiency HVAC.

What Is the Inflation Reduction Act of 2022?

The largest ever federal legislation addressing climate change, the IRA invests $369 billion in clean energy sources and technologies that improve energy efficiency. Part of this bill includes a federal tax credit available to most homeowners installing qualifying air conditioning and heat pump systems. The tax credit is 30% of the purchase and installation costs of a qualified heat pump system, up to $2000. The federal tax credit is available to most homeowners, regardless of income.

The other part of IRA consists of two different programs; the High Efficiency Electric Home Rebate Act (HEEHRA) which is also known as the “Electrification Program” and the HOMES Program. Both of these programs are focused on low to moderate income households and one or possibly both will include point-of-sale rebates for qualifying heat pump systems only, up to $8,000. (“Point-of-sale” means the rebate amount is automatically deducted from the price at the time of the sale.) However, these rebates programs will be administered by each State and program guidelines can vary state by state so it’s important to work with a qualified contractor in your state to ensure you meet the guidelines of the program.

Good news for homeowners!

Upgrading your furnace or A/C to a super-efficient model became more affordable thanks to the Inflation Reduction Act. This law gives you money back on your taxes when you choose an energy-saving HVAC system.

That’s right, you can claim up to $2,000 back on your taxes! Just imagine a new system that keeps you comfy year-round AND puts some extra cash in your pocket. Sounds pretty good.

Plus, you’ll do your part for the planet by going green. High-efficiency HVAC systems use less energy, which means less pollution and a healthier environment for everyone. Win-win!

So ditch that old clunker and invest in a smarter, cleaner future for your home. Your wallet and the planet will thank you!

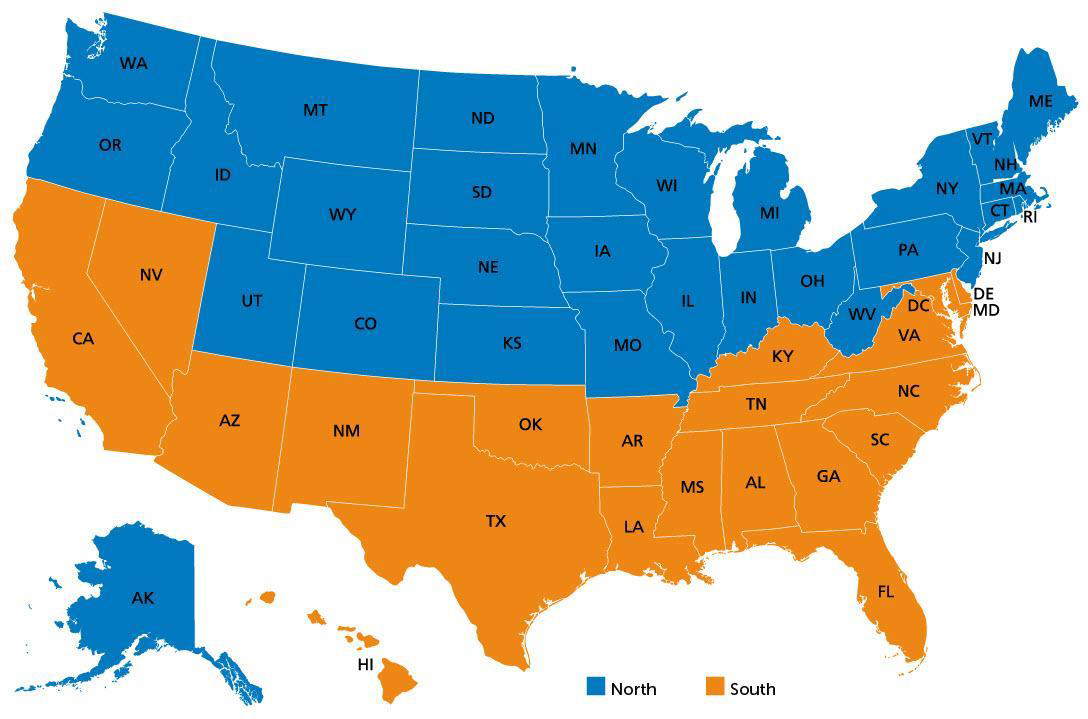

CEE Climate Regions

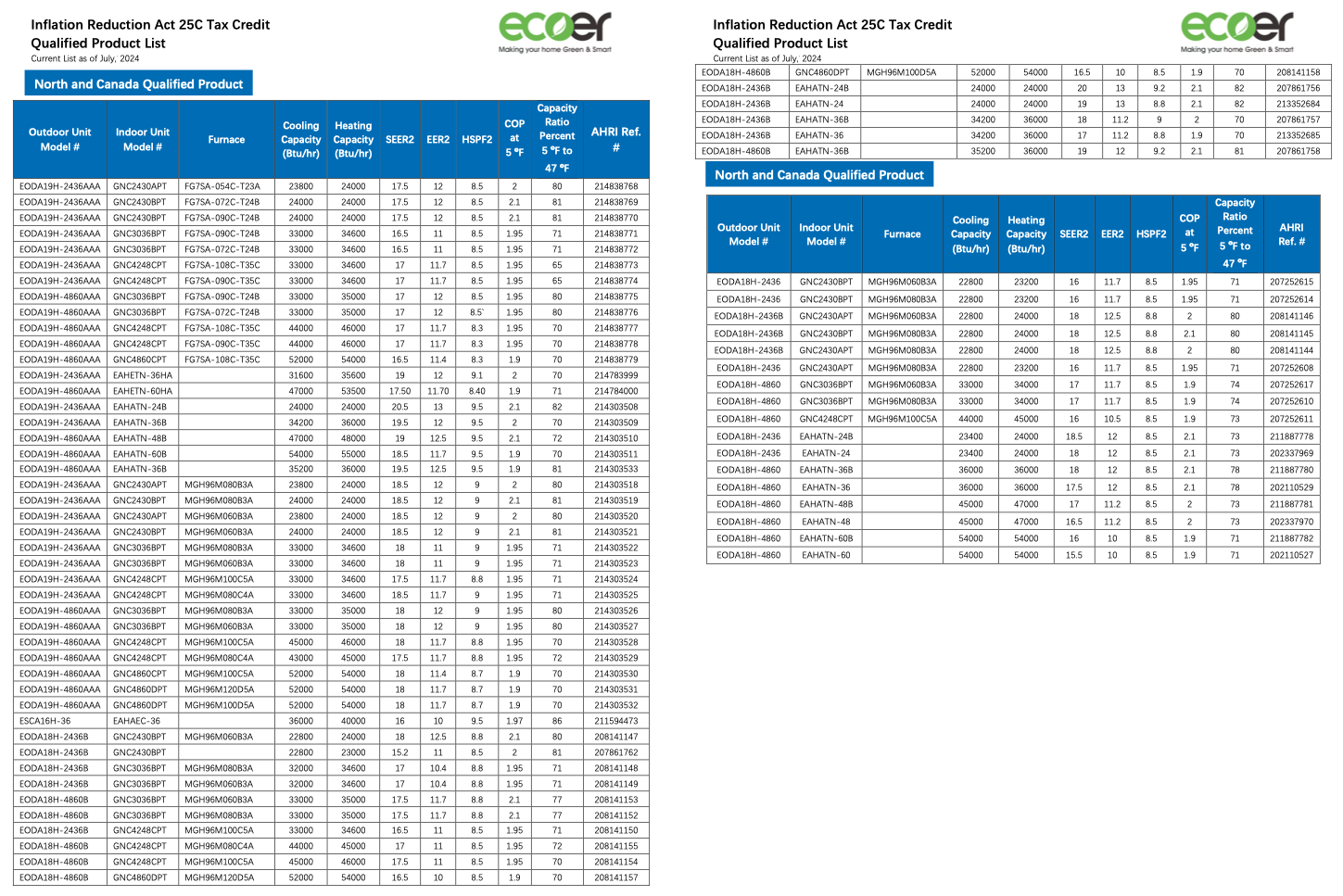

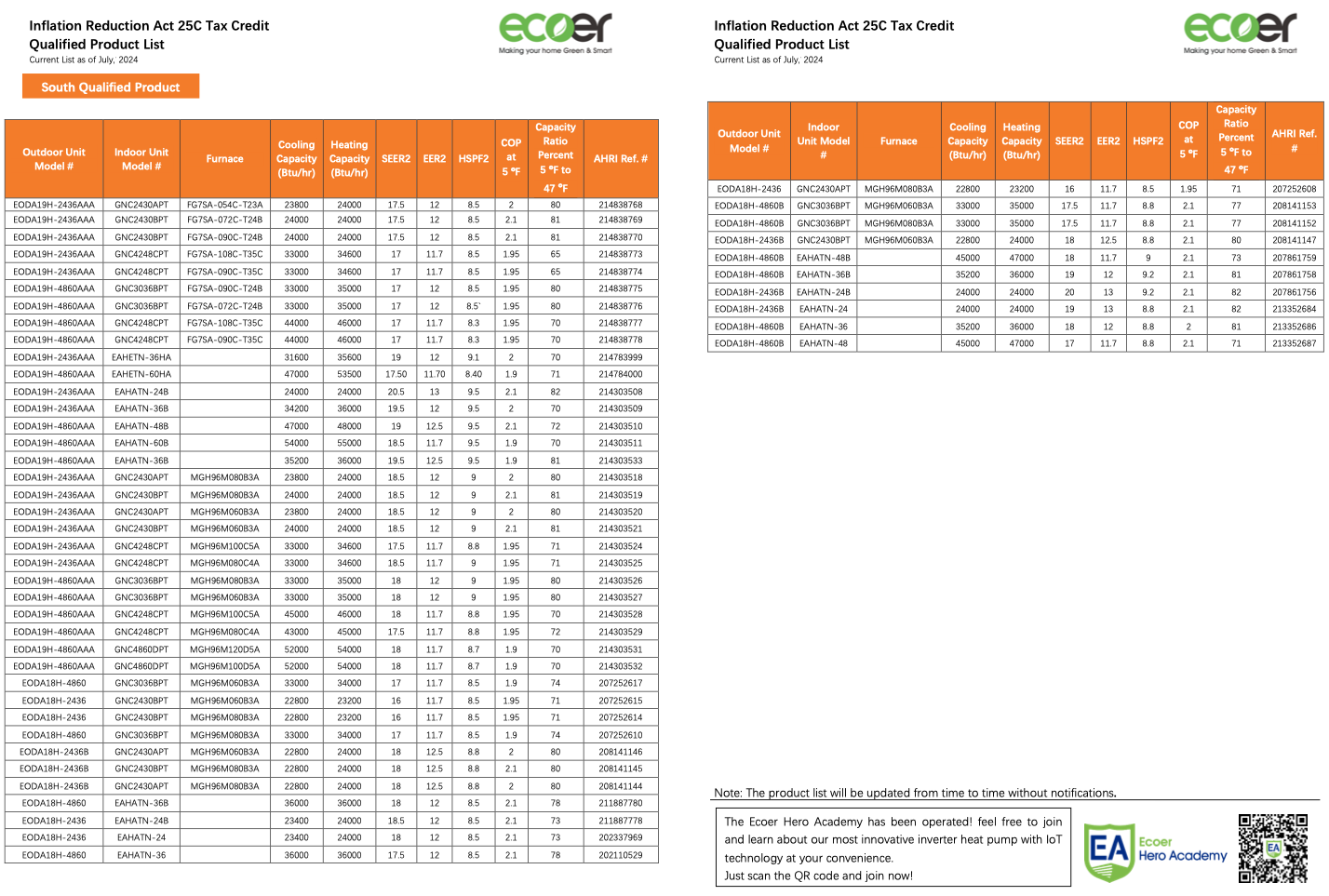

Current List as of July, 2024

North and Canada Qualified Products

South Qualified Products

How To Apply For This Tax Credit?

STEP ONE

Install a qualified clean energy HVAC system. Find a qualified dealer here.

STEP TWO

Keep your receipts and docs (including tax credit). They’ll help with tax forms later!

STEP THREE

Follow the tax form instructions and submit the IRS Form 5695 with your tax return.

If you need help explaining how it works, contact us.

For any tax advise please contact a licensed tax professional.

DISCLAIMER: Ecoer is not a tax advisor and cannot guarantee whether your purchase qualifies for tax credits. Tax laws change, so consult a tax advisor for your specific situation. We disclaim all liability for tax credit claims.

Attention Dealers & Distributors – Introducing Ecoer Hero Academy

Our new Ecoer Hero Academy is a platform that allows you to access all of our technical training in one place. We offer a fully online learning experience that you can complete at your own pace. Additionally, you have the option to participate in live webinars with instructor-led training. Please click the button below to check it out.